The Best Guide To Ach Processing

Table of ContentsSome Known Incorrect Statements About Ach Processing What Does Ach Processing Mean?Fascination About Ach ProcessingAch Processing Can Be Fun For Anyone3 Easy Facts About Ach Processing ExplainedGet This Report on Ach Processing

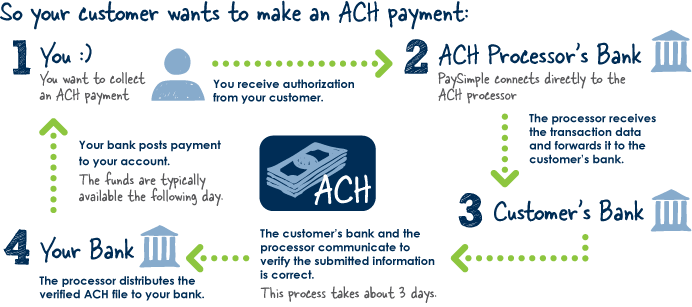

The Federal Reserve then sorts all the ACH documents and afterwards routes it to the receiver's financial institution the RDFI.The RDFI after that refines the ACH files and credit scores the receiver's (Hyde) account with 100$. The instance over is that of when Jekyll pays Hyde. If Hyde has to pay Jekyll, the exact same procedure happens backwards.The RDFI posts the return ACH file to the ACH network, along with a factor code for the mistake. ACH settlements can serve as an excellent option for Saa, S services.

With ACH, since the transaction handling is persisting as well as automated, you would not need to wait on a paper check to arrive. Likewise, given that clients have actually licensed you to collect repayments on their part, the versatility of it permits you to accumulate single repayments also. No more unpleasant e-mails asking consumers to compensate.

Not known Details About Ach Processing

Credit rating card repayments stop working due to different reasons such as run out cards, obstructed cards, transactional errors, etc - ach processing. Sometimes the customer could have gone beyond the credit rating restriction as well as that might have led to a decline. In instance of a financial institution transfer by means of ACH, the checking account number is utilized in addition to a permission, to bill the customer and also unlike card purchases, the likelihood of a financial institution transfer falling short is extremely reduced.

Account numbers seldom change. Unlike card transactions, bank transfers fail only for a handful of factors such as not enough funds, incorrect financial institution account info, etc. Likewise, the two-level verification process for ACH repayments, makes certain that you keep a touchpoint with clients. This elements in for spin as a result of unidentified reasons.

The customer initially increases a demand to pay using ACH and after that, after confirming the customer, ACH as a settlement choice is enabled for the particular account. Just then, can a client make a direct debit repayment through ACH. This verification consists of checking the legitimacy and authenticity of the checking read more account.

Ach Processing Fundamentals Explained

This secure process makes ACH a trustworthy option. For each debt card purchase, a portion of the money included is split across the various entities which made it possible for the payment.

In instance of a purchase transmitted by means of the ACH network, considering that it directly deals with the banking network, the interchange fee is around 0. 5-1 % of the total purchase.

The Best Strategy To Use For Ach Processing

Freelancing platform Upwork has utilized fascinating approaches to drive ACH adoption. They charge 3% more on the charge card deals. They charge high volume (more than $1000) individuals with only $30 level fee for unlimited ACH deals. You can drive raised adoption of ACH payments over the lengthy term by incentivizing consumers making use of benefits and advantages.

ACH transfers are electronic, bank-to-bank money transfers refined via the Automated Clearing Up Residence (ACH) Network. According to Nacha, the association responsible for these transfers, the ACH network is a set processing system that financial institutions as well as various other monetary establishments usage to aggregate these purchases for handling. ACH transfers are electronic, bank-to-bank cash transfers processed via the Automated Cleaning House Network.

Ach Processing Can Be Fun For Everyone

Direct repayments involve cash heading out of an account, consisting of bill settlements or when you send cash to somebody else. ACH transfers try here are practical, quick, and also usually free. ach processing. You may be restricted in the variety of ACH purchases you can launch, you may incur additional charges, and there may be hold-ups in sending/receiving funds.

7% from the previous year. Person-to-person as well as business-to-business purchases also raised to 271 million (+24. ACH transfers have numerous usages as well as can be much more affordable and also straightforward than composing checks or paying with a credit scores or debit card.

The Main Principles Of Ach Processing

ACH transfers can make life simpler for both the sender and recipient. Gone are the days when you needed to draw up and also wait on a check to clear, or when you had to stroll your costs settlement to the electrical business before the due day. While all of this is still possible, you currently have various other alternatives.